Also in the letter:

■ Foxconn India recall aftermath

■ Capgemini bags WNS

■ Amazon expands Now footprint

VCs back AI startups to shake up Indian IT services industry

VCs like Peak XV Partners, Stellaris Venture Partners, and Elevation Capital are going all in on AI startups that want to shake up traditional IT services. Think automation for infrastructure maintenance, software testing, and customer support, all typically heavy on people and cost.

The pitch:

- Peak XV is scouting “agentic AI” startups to automate application maintenance.

- Elevation sees automation potential across BPO, KPO, and customer support.

- Stellaris has already backed two startups tackling core IT services.

India edge: “ We (India) know how to scale people-heavy ops and sell services, not just software,” says Stellaris’s Ritesh Banglani. “Our bet is that tech-first services startups will be able to build distribution faster than the incumbents can build technology.”

Money talk: By charging for outcomes, AI-first startups can “price like services but earn like software,” says Accel India’s Anagh Prasad.

Zoom out: Not just VCs, Masayoshi Son’s SoftBank is eyeing buyouts in India’s AI-powered IT and BPO space too. Investors are also betting on teams with deep domain chops from legacy IT giants.

What’s next: AI adoption is widening the gap between revenue and headcount growth at big IT firms. But what does this mean for millions of IT jobs? Still a big question mark.

Also Read: Tech professors turn startup founders, VCs take note

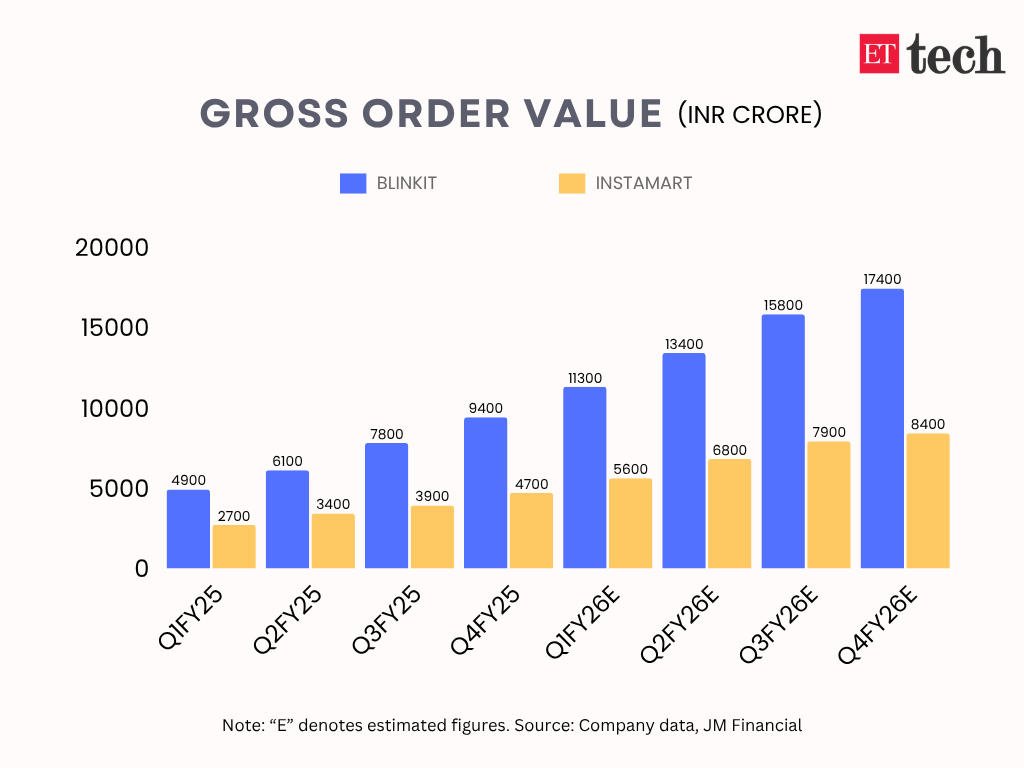

Blinkit and Instamart pull ahead as Zepto slows down

Quick commerce stars Blinkit (owned by Eternal) and Swiggy’s Instamart are estimated to have gained market share in April–June, while Zepto slowed down, according to analysts.

By the numbers:

- Blinkit’s gross order value (GOV) grew over 25% QoQ.

- Instamart rose by around 22%.

- Meanwhile, the overall sector grew less than 20%, signalling these two are pulling ahead.

User trends:

- In December 2024, Zepto and Blinkit each had around 5.5 million daily active users (DAUs).

- By June 2025, Zepto’s DAUs fell to 4.9 million, while Blinkit surged to 6.2 million.

- Instamart’s new standalone app (launched in January) hit 1.1 million DAUs by June — and it’s also still live inside Swiggy’s main app.

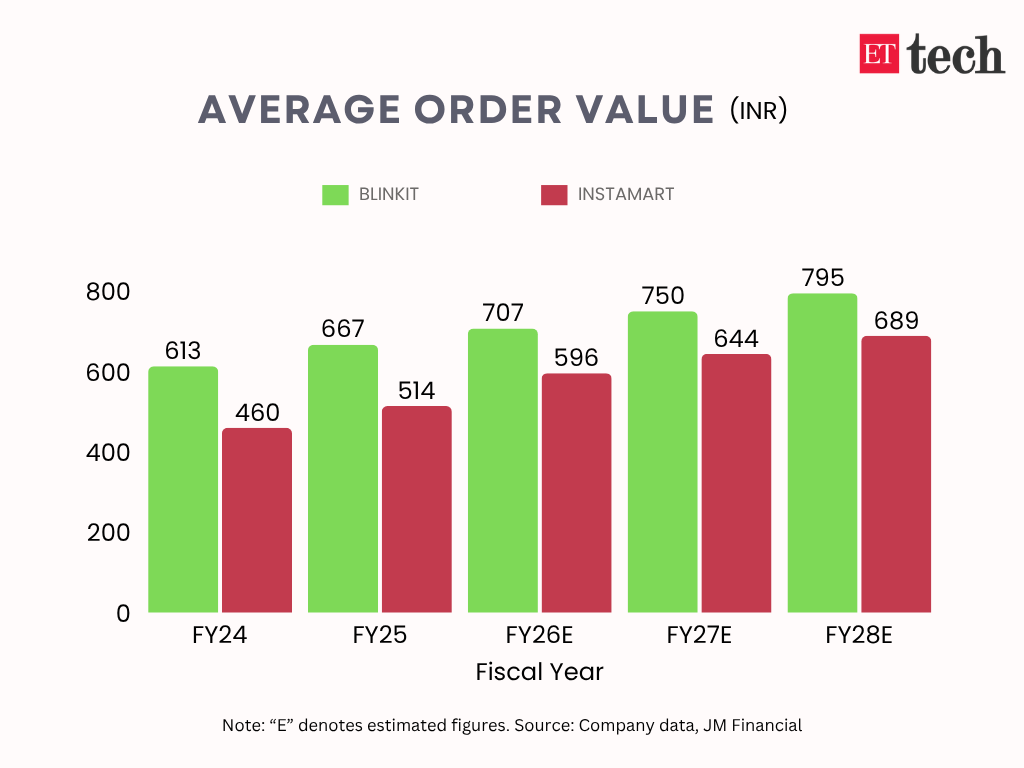

Why it matters: As competition cools, platforms are shifting focus to unit economics, cutting discounts, reining in marketing spend, and pushing higher average order values (AOVs).

Also Read: Quick commerce apps stack up extra fees to curb losses

Sponsor ETtech Top 5 & Morning Dispatch!

Why it matters: ETtech Top 5 and Morning Dispatch are must-reads for India’s tech and business leaders, including startup founders, investors, policy makers, industry insiders and employees.

The opportunity:

- Reach a highly engaged audience of decision-makers.

- Boost your brand’s visibility among the tech-savvy community.

- Custom sponsorship options to align with your brand’s goals.

What’s next: Interested? Reach out to us at spotlightpartner@timesinternet.in to explore sponsorship opportunities.

Foxconn feels the China squeeze in India

Foxconn is recalling over 300 Chinese engineers from its Indian iPhone plants at Beijing’s insistence. While these engineers can be swapped with Taiwanese talent, the bigger headache? Machinery.

Why it matters: China is a key supplier of affordable manufacturing equipment. If Beijing restricts exports or servicing, it could derail Indian operations and slow expansion plans. Smaller manufacturers, who rely heavily on Chinese gear to keep costs low, are especially vulnerable.

Industry chatter:

- “Capital machinery roadblocks will hurt more than losing engineers,” says Neil Shah of Counterpoint.

- Other EMS firms haven’t felt similar pressure yet, hinting this move is targeted at Foxconn.

Big picture: Some execs see this as a “niggling pain” that large players like Foxconn can absorb, while smaller firms with thinner margins may struggle.

A silver lining? Experts say this could push India to develop its own capital goods manufacturing — but that’ll take time, as these machines are highly complex and China has a big head start.

Capgemini’s $3.3 billion WNS buy: Big move, big questions

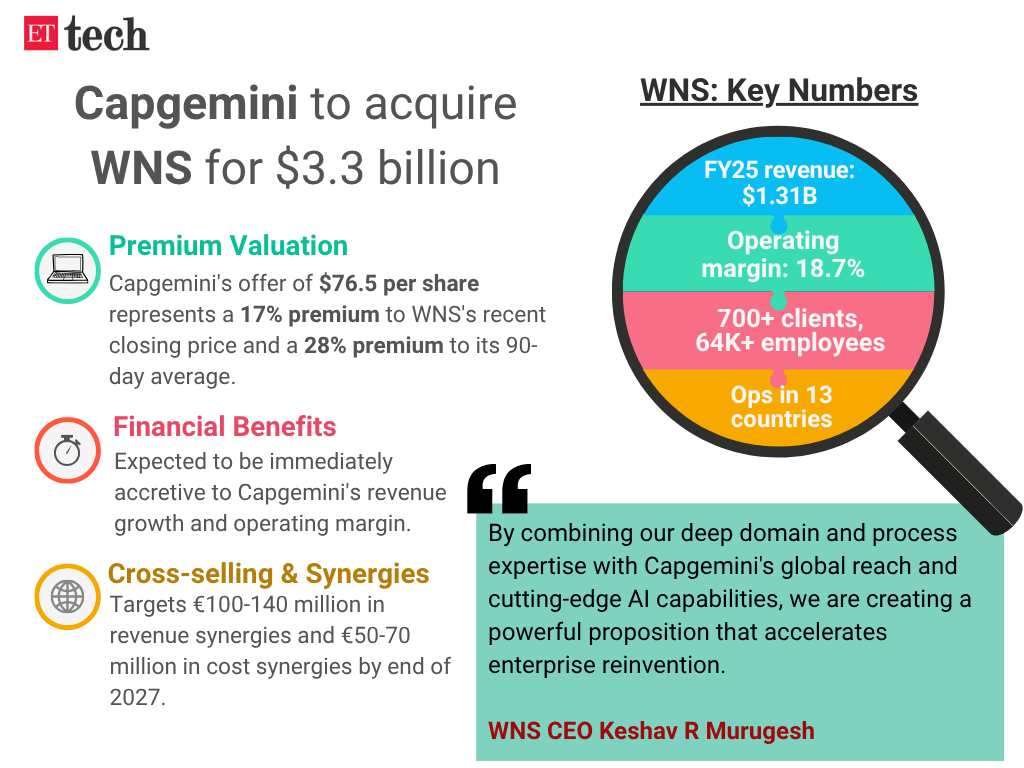

French tech giant Capgemini is set to acquire WNS, an Indian-origin business process management (BPM) firm, for $3.3 billion (about Rs 28,280 crore) in cash. That’s $76.50 per share, a 17% premium to WNS’s recent closing price.

Why it matters: WNS, founded in Mumbai and now US-listed, specialises in BPO ( business process outsourcing) and data analytics for clients like Coca-Cola, T-Mobile, and United Airlines. Capgemini expects the deal to immediately boost revenue growth and margins, and lift earnings per share by up to 7% by 2027.

The AI twist: Capgemini is betting big on merging WNS’s deep domain expertise with its AI capabilities, think Gen AI and Agentic AI, to create advanced, data-driven services. WNS CEO Keshav Murugesh says it’s about shifting from “automation to autonomy” and helping clients cut operating costs by as much as 40%.

WNS in numbers:

- FY25 revenue: $1.31 billion (down around 0.6% YoY).

- Operating margin: 18.7%.

- 700+ clients, 64,000+ employees.

- Operations in 13 countries from 64 delivery centres.

What analysts think: Morgan Stanley analysts flagged that AI could make BPO a more automated, less people-intensive sector, potentially reducing revenues and increasing competition. They also noted WNS is too small to dramatically move Capgemini’s around $25 billion needle but adds around 19% to headcount.

Market vibes: Capgemini’s shares closed 5.6% lower after the announcement, hitting their lowest level since April. Investors are wary of the short-term balance sheet impact and long-term AI risks.

Also Read: SoftBank eyeing buyout deals in India to push AI-led IT, BPO operations

Keeping Count

OpenAI achieved the milestone within three years of launching its popular AI chatbot, ChatGPT. This marks a substantial increase from $5.5 billion in December 2024. (Source: CNBC, Crunchbase)

Other Top Stories By Our Reporters

Amazon Now arrives in Delhi: Amazon has started offering its quick commerce service, Amazon Now, in a few localities in Delhi, after launching it in Bengaluru last month.

RackBank explores non-metros to cut costs: AI infrastructure startup RackBank is looking to expand data centres in tier-2 cities like Indore and Raipur to reduce its operational cost by 2–3x as compared to data centre hotspots like Mumbai, Chennai and Noida.

Global Picks We Are Reading

■ People are using AI chatbots to guide their psychedelic trips (Wired)

■ Meta’s grand WhatsApp fintech experiment in India has fizzled (Rest of World)

■ Robotic probe quickly measures key properties of new materials (MIT News)